I use options just to hedge my investments. However I know lot of traders who trade only options to make money.

There are many factors which decide your success as an options trader, but you would never want to fall behind in this game just because of your broker. Choosing the best stock broker for options trading in India would give you an edge in many ways in 2026.

There are many factors which are affected by stock broker as far as options trading is concerned. I will list down them in next sections of this article.

It is believed that options buyers hardly makes money in long run. Because time value (theta) of options decreases on each passing day.

Options seller theoretically has unlimited loss potential. But sellers are experienced traders who know how to mitigate the risk and come out with minimum loss.

We will also see who is the best broker in India for Options selling (Writing).

What is Options trading

Options trading is advanced level of trading, suitable for experienced traders.

Options are nothing but contract between two parties (buyers and sellers of options) to buy or sell shares at a fixed price on or before pre-decided date.

Usually the shares are brought or sold in predefined numbers and it is called a “lot”

For example, Reliance Industry has lot size of 1000. That means the buyer and seller should come to agreement to buy/sell minimum 1000 shares or in multiple of 1000 shares of Reliance Industry

Options are basically of two types namely Call Option and Put Option. I will write separate article on basics of options trading , as of now lets check who is the best broker for Options trading in India.

Qualities of the Stock Broker who is best suited for Options trading

There are hundreds of stock brokers out there in India who offer service in options segment. But all brokers are not good for options trading.

I am listing few pointers which would help in identifying the broker who is better suited for options trading.

- Brokerage : Make sure that your profits are not cut down because of the higher brokerage you pay. Some brokers charge on per lot basis and some other fixed brokerage irrespective number of lots. Obviously you need to choose the second category of brokers for options trading. (Read : Lowest Brokerage charge brokers of India)

- Leverage : Exposure/margin are very important if you are interested in selling (writing) options. (Read : Stock Brokers with highest leverage in India)

- Trading Terminal :You would be interested to checking support and resistance levels using the chart to arrive at strike price. So it is critical to have state of the art charting tools. ( Read : 9 Best trading platforms of India)

- Mobile Apps : You may not be infront of system all the time. So check what features the mobile app of the brokers are suitable for you. ( Read : 7 Best Mobile trading apps of India)

Best Options Trading Brokers in India 2026

With the points given above, I have shortlisted 6 good share brokers for Options trading based on customer ratings.

Below is the list of best stock broker for Options trading in India,

- Zerodha Stock Broker for options trading

- Upstox Stock Broker for options trading

- Angel Broking Stock Broker for options trading

- 5Paisa Stock Broker for options trading

- Trade Smart Online Stock Broker for options trading

- FYERS Securities Stock Broker for options trading

#1 Zerodha Stock Broker for Options Trading

Zerodha is my favourite broker and I trade with them. Trading with them has resulted in lot of savings to me.

They are pioneer of discount broking concept in India. Now they are the largest stock broker of India overtaking ICICI Direct and Sharekhan.

- Brokerage : They charge Flat Rs20/executed order irrespective of number of lots. Delivery based trades are completely free.

- Leverage: They offer 3 times or 40% NRML margin

- Trading Terminal: KITE is the trading erminal from Zerodha and it is completely free. It is considered as one of the best terminal of India

- Mobile APP : Zerodha KITE mobile is the light weight and low on resource mobile app from them.

What I like most in Zerodha is the minimalistic nature of their trading terminal KITE. It is clutter free and does not have those blinking news distractions.

It lets me to concentrate on what is important to me and trade with calm mind.

Following table illustrates the summary of the Zerodha Brokerage Charges

Following is the detailed break down of the charges by Zerodha for Options segment.

Suggested Read: Detailed review and comparison of Zerodha Brokerage

How much Brokerage can be saved in Options trading with Zerodha?

Now, let us calculate how much savings a Options trader can do if he opens an account with Zerodha instead of a fullservice broker.

Let us assume you buy 10 lots of nifty when it is at 12000 and sell them when it is at 12100.

Sharekhan charges Rs100 per lot. Hence for 10 lots it will be Rs 1000 for buying and another Rs1000 for selling. So, in average for 20 trading days in a month, total brokerage would be Rs 2000*20 = Rs40,000

So yearly it would be,

Rs40,000 * 12 months = Rs 48,00,000 (Sharekhan)

Now Zerodha charges Rs 20/trade. In Zerodha, brokerage is not based on number lots. For each order they charge Rs20 irrespective of number of lots.

Hence per day it would be Rs 40 (Rs20 for buy and Rs20 for sell) and for each month it would be 20* Rs40 = Rs 800

So per year it is Rs 800 * 12 months = Rs 9,600 (Zerodha)

Hence, traders can save more than 90% of brokerage and indirectly add to their profit.

Particularity, for Options traders discount brokers are must and Zerodha is a reputed discount broker of India.

Because of all these advantages, they could overtake the likes of ICICI Direct and Sharekhan to become largest stock broker of India.

I opened account with them in year 2012 and I can say that, I’m pretty satisfied with their products and services.

Zerodha Account Opening Charges:

- Online through Aadhaar : Rs 200

- Offline by submitting forms : Rs 400

Account in Zerodha can be opened within 15 minutes if your mobile is linked to your Aadhar number. Check out detailed Step by step procedure on how to open Zerodha account with screen shots.

SaveRs200: you can save Rs200 by opening the account online. Use below Link to save Rs 200. It can be opened completely online without any paperwork.

#2 Upstox Stock Broker for Options Trading

Upstox was formerly known as RKSV securities. They are Mumbai based discount stock brokers who started almost at the same time as that of Zerodha

Suggested Read : Detailed review of Upstox and their offerings

- Brokerage : Their brokerage plan is almost identical to that of Zerodha. They charge Flat Rs20/executed order irrespective of number of lots. But delivery based trades are not free.

- Leverage: Upstox has two brokerage plans (Priority charges are Rs30/order). With Basic plan they provide 3x margin and with Priority pack they provide 4x margin for options

- Mobile APP : Upstox Pro Mobile is a powerful feature loaded trading app from Upstox

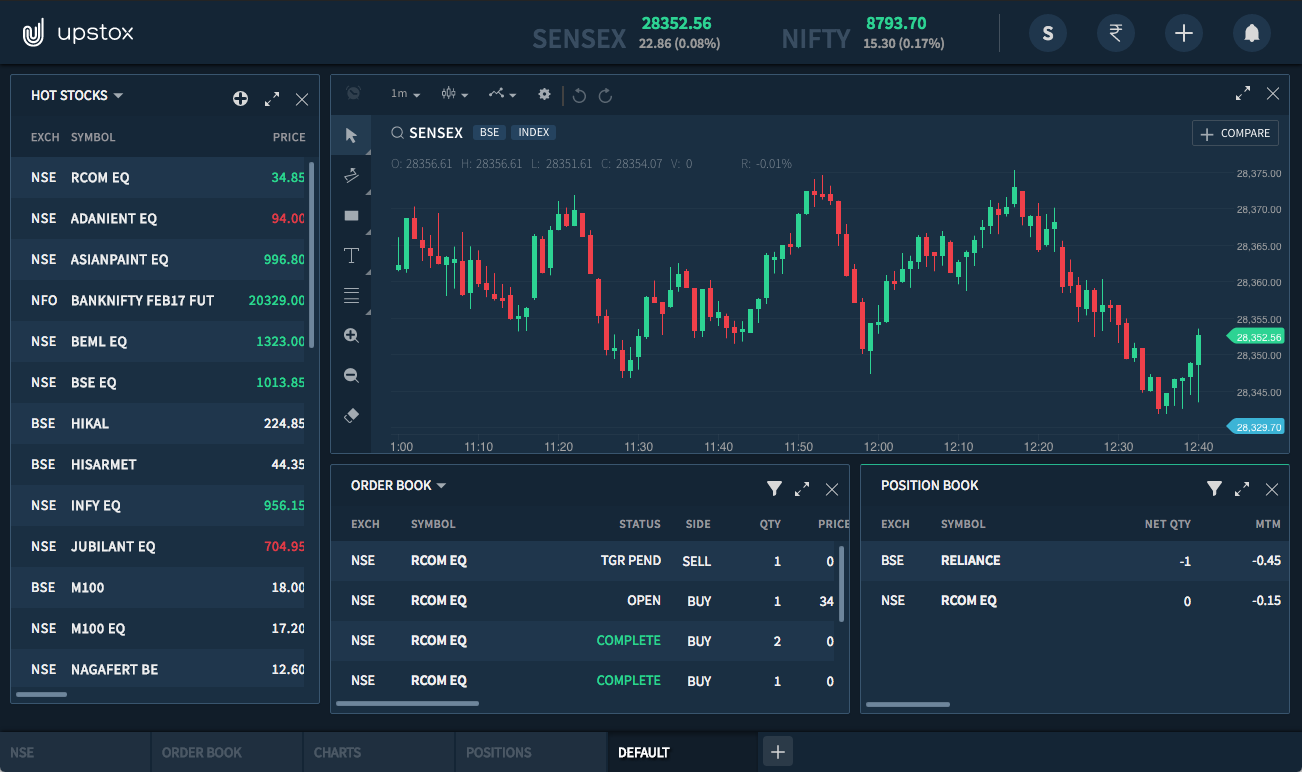

- Trading Terminal: Upstox PRO is the trading terminal from Upstox and it is also completely free.

Also Read : Zerodha Vs Upstox Side by side comparison

Following table illustrates the summary of the Upstox Brokerage Charges

Following table has the detailed breakdown of the charges levied by Upstox for Options Segment

Screenshot of the Upstox Pro trading terminal .

Currently Upstox have waived off the account opening fee. So, you can open the demat and trading account with them free of cost. Use below button to avail the offer.

#3 Angel Broking Stock Broker for Options Trading

Angel Broking is in the brokerage industry since 1987. Apart from brokerage, they also offer service in Portfolio Management Services (PMS) and Life insurance.

They followed full service mode until 2019 and used to charge Rs 75 /lot for options.

But now they have adopted the discount brokerage model and charge Rs20/trade which at par of industry charges.

for more information about Angel Broking, check out this detailed review.

- Brokerage : Rs 20/trade for options segment. Zero brokerage for delivery

- Leverage: Angel Broking provide 4x margin for options selling.

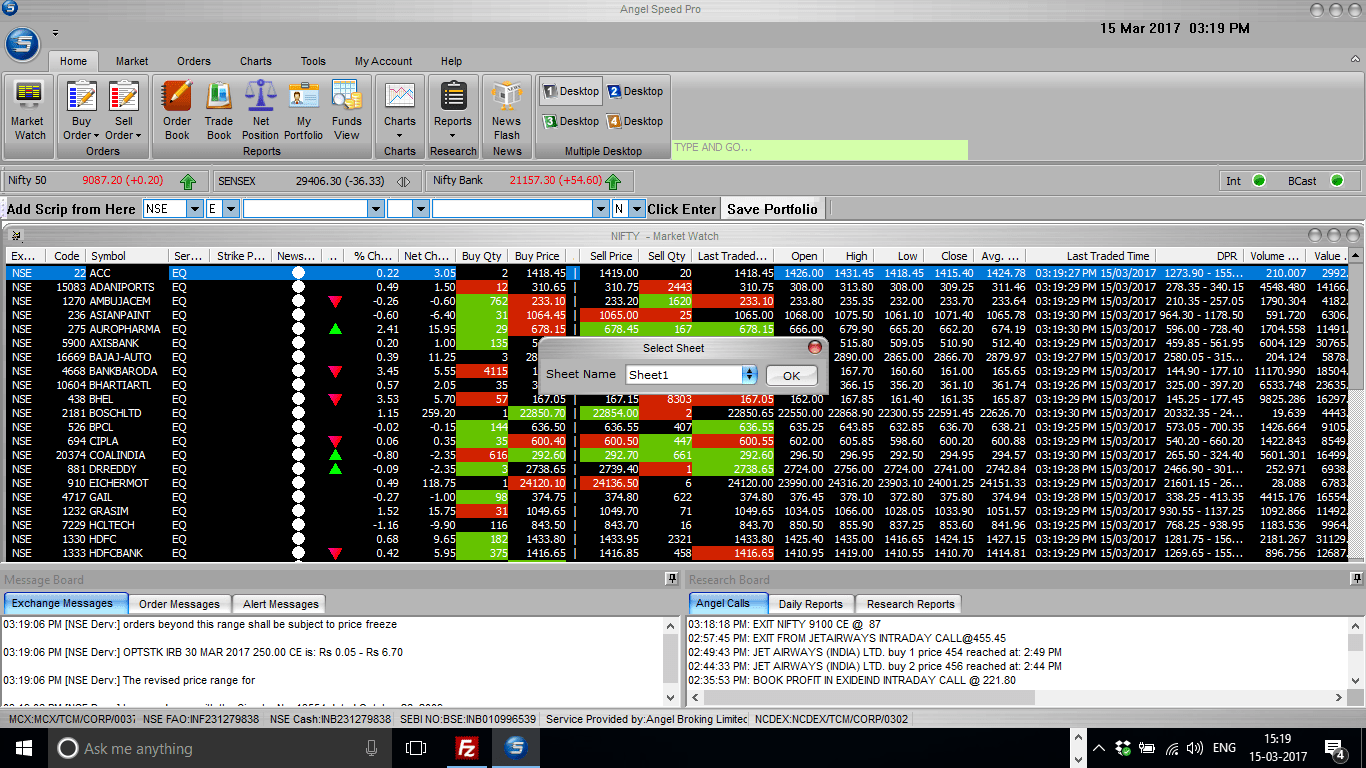

- Trading Terminal: Angel Broking Speed Pro is the terminal offered by Angel Broking

- Mobile APP : Angel Broking Mobile is the mobile app from them

Following table illustrates the summary of the Angel Broking Charges

Following table has the detailed breakdown of the charges levied by Angel Broking for Options Segment

Screenshot of the Angel Speed Pro trading terminal.

To avail the Zero account opening charges with Angel Broking, use below button. Also you will get AMC charges for first year waived off.

#4 5Paisa Stock Broker for Options Trading

5Paisa is discount brokerage arm of India Infoline. (IIFL). IIFL are well established stock broker of India with more than 3 decades in to stock broking.

Suggested Read: Detailed review of 5Paisa and trading Platforms

- Brokerage : Probably 5Paisa charges lowest brokerage charges for options trading in India. They charge Flat Rs10/executed order irrespective of number of lots. Delivery based trades are also charged at the same rate..

- Leverage: 5Paisa provide 2x margin for options selling.

- Trading Terminal: 5Paisa trade station is the terminal offered by 5Paisa.

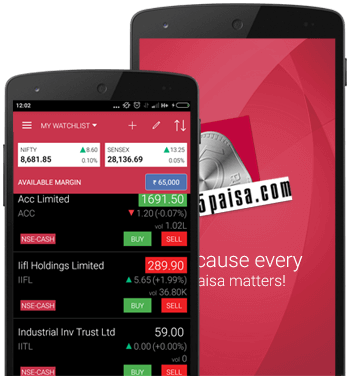

- Mobile APP : 5Paisa mobile is the mobile trading app of 5Paisa

Also Read : 5Paisa Vs Zerodha side by side comparison

Following table illustrates the summary of the 5Paisa Brokerage Charges

Following table has the detailed breakdown of the charges levied by 5Paisa for Options Segment

Below is the screenshot of the 5Paisa Mobile Trader

#5 Trade Smart Online Stock Broker for Options Trading

TradeSmartOnline is discount brokerage subsidiary of VNS Capital and Financial Limited. VNS is well known broker in Mumbai with more than 3 decades of brokerage experience.

Read : Detailed review of TradeSmartOnline and their products

- Brokerage : TradeSmartOnline charges flat Rs15/executed order..

- Leverage: They provide upto 3x margin for options selling.

- Trading Terminal: They also provide NEST Trader which is developed by 3rd party called Omnesys Technologies.

- Mobile APP : SINE mobile is an app with slim design which helps in trading on the go.

Following table illustrates the summary of the TradeSmartOnline Brokerage Charges

Following table has the detailed breakdown of the charges levied by TradeSmartOnline for Options Segment

Below is the screenshot of the VNS Sine mobile app.

#6 FYERS Securities Stock Broker for Options Trading

FYERS Sercurities is Bangalore based discount stockbroker. They don’t have any branch other than Bangalore.

FYERS stands for – Focus Your Energy & Reform Self.

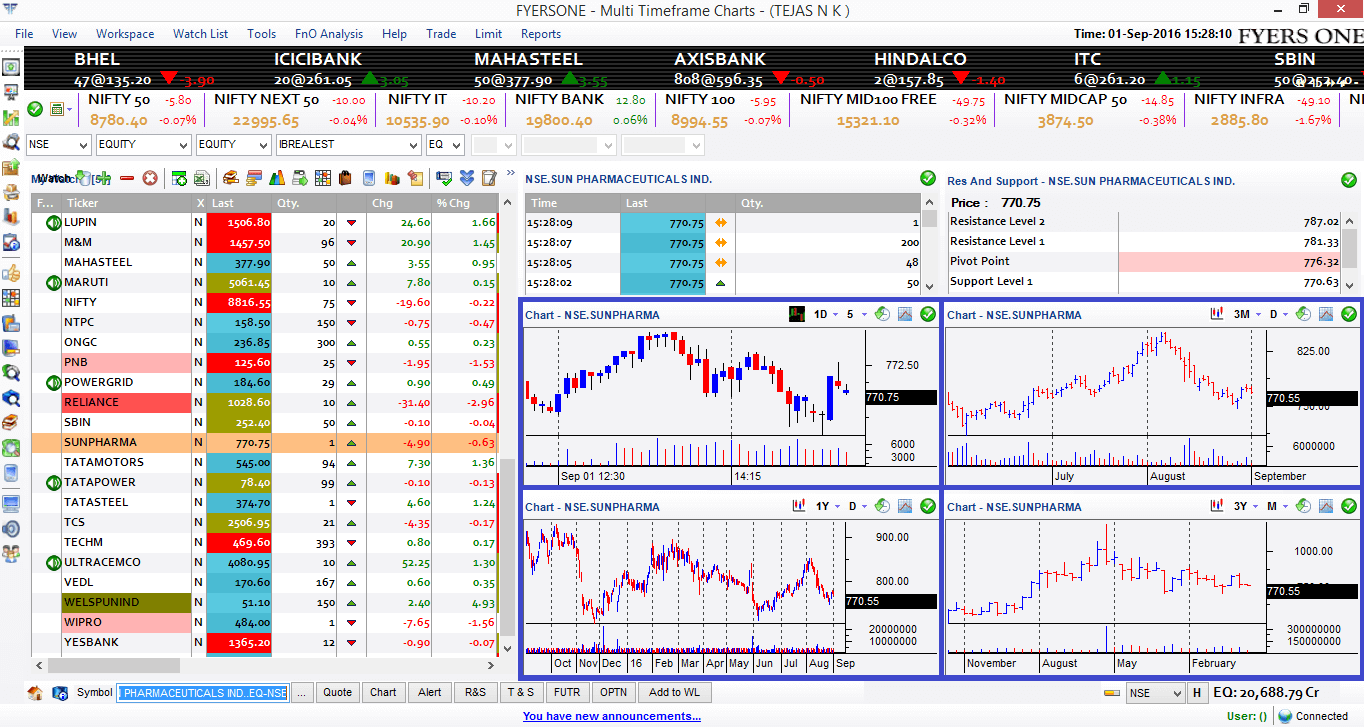

They also have their own in house trading Terminal namely, FYERS ONE and FYERS Market.

Account opening is free at FYERS.

Suggested Read : Detailed review and Comparison of FYERS broker

- Brokerage : Brokerage of FYERS is Flat Rs20/executed order irrespective of traded value.

- Leverage: FYERS provide 2x margin for options selling.

- Trading Terminal: FYERS provide FYERS ONE which is developed FYERS themselves

- Mobile APP : FYERS mobile app is known as FYERS Market

Following table illustrates the summary of the FYERS Brokerage Charges

Following table has the detailed breakdown of the charges levied by FYERS for Options Segment

Below is the screenshot of the FYERS ONE terminal

Cheap and Best Broker for trading Options in India – Final Thoughts

One thing is for sure, you need to go with discount brokers who provide you with lowest brokerage charges for options trading in India, irrespective of whether you trade by buying or selling Options.

On the same time, please do not compromise on the integrity and reputation of the broker. There are few brokers who even charge you as cheap as Rs5/order. But you don’t know when they will shut their shop.

So always go with the best broker for options trading, preferable one among the list I provided above.

As I said earlier, I trade with Zerodha. I like their trading terminal’s (KITE) user interface. It is clean and clutter free. I has just minimum details which I need for my trade.

You May Also Like To Read :

- 10 Best Discount Brokers of India who can reduce your trading costs significantly

- 5 Best Stock Brokers for Day trading (Intraday trading) in India

- Top 7 Commodity brokers of India to trade in Commodity Segment

- Stock Brokers best suited for applying to IPO Investments

- 10 Leading Brokers who provide High Margin and also Low Brokerage

- Stock Brokers Who are Known For their Best Customer Service in India

- List of Stock Brokers having Highest Active Clients in India

- Tool to do Side By Side Comparison of Any Two Stock Brokers of India

- Find the Best Stock Broker In Your City

- How to Choose the Best Stock Broker In India as per your Requirement